Green Bond Project Team, Shenzhen Stock Exchange

“Swallows fly around, and emerald water surrounds our homes,” as ancient Chinese poets wrote, putting their expectations for nature into words and songs, reflecting human beings’ unremitting pursuit of a better and sustainable life. Nowadays, China is entering a new stage of green and low-carbon high-quality development. It is the responsibility of the Shenzhen Stock Exchange as an important hub of the capital market to actively aggregate the flow of social capital and innovation resources into the sustainable development field.

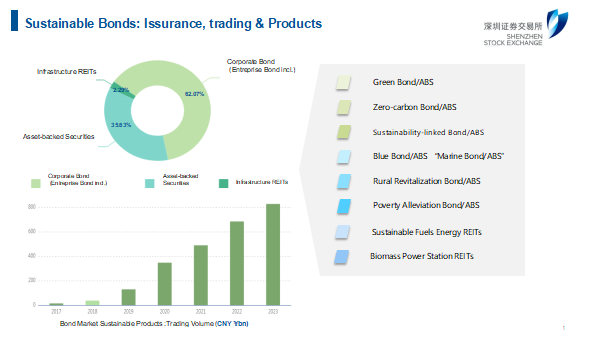

According to UN SSE statistics, listed companies on the Shenzhen Stock Exchange performed the best with regard to total carbon emissions among the G20 countries’ exchanges. With a total market value of more than 6.5 trillion yuan in sustainable industries, the Shenzhen Stock Exchange attaches great importance to sustainable development. In addition to the equity market, the SZSE bond market has continued to increase the supply of sustainable financial products, enhancing sustainable financial services, and making outstanding achievements in gathering patient capital for sustainable development:

I. The Supply of Sustainable Financial Products

The Shenzhen Stock Exchange launched green bond issuance in 2017, and it has continuously guided resources towards fields such as green transportation, clean energy and environmental governance. That helps accelerate the development of green and low-carbon industries. In addition, the SZSE has rolled out blue bonds to fund marine protection projects and support the sustainable use of marine resources, low-carbon transition bonds that raise funds mainly for low-carbon transformation fields, as well as low-carbon transition-linked bonds with embedded clauses that encourage innovation. These products help broaden the range of bonds in the green and low-carbon field and provide financial support for green development and economic transformation.

II. Building Up the Secondary Market

The Shenzhen Stock Exchange adheres to the investor-oriented concept of focusing on enhancing the returns of those who invest patient capital in sustainability-related bonds. By facilitating pledged repurchase arrangements, the SZSE allows investors to pledge their mid-and high-grade bonds to gain financing in the form of a CCP settlement; the SZSE is also committed to improving the liquidity of sustainability-themed bonds, and encouraging market makers to provide market-making services for green bonds, rural vitalisation bonds, etc.

III. Sustainable Financial Services

Recently, the Shenzhen Stock Exchange has also launched a special zone for sustainable financial services on its official website. The website provides abundant resources, ranging from regulations, sustainable financial-product information, training courses, research reports and PLC sustainable cases and more. “One stop” services have increased SZSE's capacity to provide sustainable services, which facilitate the convenient query and use of sustainable resources.

After years of practice in sustainable development, the SZSE bond market has accumulated many excellent cases, covering REITs, bonds, ABS and other products:

I. Penghua Shenzhen Energy REIT

The Penghua Shenzhen Energy REIT, issued by Shenzhen Energy Group, is based on one of the clean energy power plants with the largest installed capacity, the most advanced equipment and the highest efficiency. Located in Shenzhen, the core city of the Guangdong-Hong Kong-Macao Greater Bay Area, the project has played an important role in promoting Shenzhen's economic development, strengthening the reliability of power grid operation, and balancing the power supply structure. In the REIT inquiry stage, the proposed subscription amount from all placement targets was 108.15 times the initial offline offering amount, setting a record for the infrastructure REITs industry at that time.

Shenzhen Energy Powerhouse (Dapeng New District, Shenzhen)

II. China Tianying Technology Innovation and Blue Bond

All the proceeds raised are used to build the first gravity energy storage project in China, "100MWh gravity energy storage in Nantong City," which stores clean resources such as offshore wind power and photovoltaic power generation in the form of gravity potential energy, further improves the energy utilisation efficiency, and helps the protection and sustainable use of marine resources. The project can supply 100MWh of electricity per day without using excess energy and increasing carbon emissions, which is expected to reduce carbon dioxide emissions by more than 40,000 tons per year compared with coal-fired power generation.

III. Carbon Asset Based Securities

In July this year, the Shenzhen Stock Exchange innovated the carbon finance model, listing carbon asset-based securities—the SME No.19 Asset-Backed Securities (Carbon Asset). The SZSE-listed Carbon Asset Based Securities help strengthen the liquidity of the carbon market and expand the national carbon trading market. Carbon asset securitisation products use the pledge loan of corporate carbon emission rights as the basic assets, and provide financing support for enterprises through the issuance of market-circulating securities, effectively improving the liquidity and market value of carbon assets. Through carbon asset securitisation, the owner of carbon assets can still retain the autonomy of carbon assets in the process of financing, and investors can obtain future benefits generated by carbon assets by purchasing securities without directly owning carbon assets. The actual financing cost of carbon asset securitisation products in the current period was 2.9%, which was about 290BP lower than the daily financing cost of enterprises on average.

The cases above continue to inspire us. The SZSE plans to put further efforts into sustainable market development.

Firstly, we will continuously expand the scale of green bonds, enrich innovations of sustainable fixed-income products, and further promote the listing and fund raising of REITs in sustainable fields, so as to better meet the diversified asset allocation needs of investors.

Secondly, we will strengthen our secondary bond market, provide more efficient and convenient trading channels for sustainable bond investors, and encourage market makers to provide high-quality quotations for sustainable bonds.

Thirdly, we will further enrich the content and features of the SZSE’s specialised sustainable financial services on the website, by launching an English version, so as to provide better services for international issuers, investors and researchers.

As an ancient Chinese adage goes: "With one heart and one mind, we can accomplish everything we aspire to." The SZSE looks forward to putting more effort into constructing a high-quality and sustainable financial system with our partners, and thus aggregating patient capital for sustainable developments.